The following is a list of the documentation required to be considered for National Standards accreditation. This documentation will be required in Section 1 of the application.

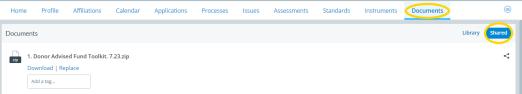

Sample documents are available within the application program. Go to the Documents tab and then select shared.

Note: If you are concerned about the complexity of any of your legal documents, please contact the National Standards staff at submissions@cfstandards.org to set up a conversation about your questions or concerns.

All community foundations applying for National Standards accreditation must present each of these documents for review.

Articles of Incorporation

Articles of incorporation and/or trust documents that are signed and dated by the appropriate corporate officer, such as a corporate secretary. Please include attachment of the original plus any amendments.

Bylaws

Bylaws that are signed and dated by the appropriate corporate officer, such as the corporate secretary, and include the date of board approval. Please include attachment of the most recent version.

Board Resolution

Include as an attachment the board resolution for National Standards submission.

Financial Statements

You must include your financial statements for the most recent 12-month period. For community foundations with more than $5 million in assets, these are your audited financial statements with disclosure notes and management letter by an independent CPA. For community foundations with assets less than $5 million, these are your financial statements with disclosure notes reviewed by an independent CPA. If supporting organizations' assets are not included in the audit, you must submit this documentation. Also include date of board approval.

Note: If your community foundation has a modified audit because one or more of your supporting organizations' assets are not included in the audit, you must submit additional documentation to pass National Standards. Please see additional information here.

Form 990

You must provide most recent Form 990 with signature or Form 8879 proof of signature. Include all schedules and attachments, except Schedule B. Also include the date of board approval.

The National Standards reviewers often find the following issues on the Form 990:

- Fundraising Expenses: The IRS requires community foundations to record fundraising expenses. Zero fundraising expenses will be a red flag for the IRS and National Standards reviewers.

- Sponsoring Organization: In Part V, 8, 9a, and 9b are required to be answered if your community foundation has donor advised funds. If your community foundation does not hold donor advised funds, please clarify that point.

IRS Determination Letter

Attach your IRS determination letter. You must show 170(b)(1)(a)(vi).

Confidentiality Policy

Attach the confidentiality policy with the date of board approval.

Conflicts of Interest Policy

Attach the conflicts of interest policy with the date of board approval.

Nondiscrimination Policy

Attach the nondiscrimination policy with the date of board approval.

Investment Policy

Attach the investment policy with the date of board approval.

Spending Policy

Attach the spending policy with the date of board approval.

Gift Acceptance Policy

Attach the gift acceptance policy with the date of board approval.

Grantmaking Due Diligence Policy

Attach the grantmaking due diligence policy, including expenditure responsibility, with the date of board approval.

Record Retention Policy

Attach the record retention policy with the date of board approval.

Whistleblower Policy

Attach the whistleblower policy with the date of board approval.

Social Media Policy

Attach the social media policy with the date of board approval.

Note: A social media policy applies to the use of websites and applications that enable users to create and share content or to participate in social networking.

Fund Agreements

You must provide a fund agreement for each type of fund your community foundation offers. This will require multiple attachments. Include the date of board approval.

Gift Acknowledgment

You must provide a gift acknowledgment for each type of gift. This will require multiple attachments.

Donor-Initiated Fundraising Policy

Attach the donor-initiated fundraising policy with the date of board approval.

Fiscal Sponsorship Agreement

Attach the fiscal sponsorship agreement with the date of board approval.

Affiliate Fund Agreement

Attach the affiliate fund agreement with the date of board approval.

Grant Agreements

Attach each type of grant agreement with the date of board approval. Please note, for many applicants there is only one type of grant agreement and that agreement may be in your grant award letter if that letter includes grant conditions and often an evaluation form.

While your foundation is not required to undertake the following activities, if it does, please attach the requested legal documentation.

Donor-Advised Fund Guidelines or Policy

Attach the donor-advised fund guidelines or policy that reflect the legal regulation of donor-advised funds that you share with the donor. Include the date of board approval.

Fund Activity Policy

Attach the fund activity policy with the date of board approval.

Scholarship Policy

Attach the scholarship policy with the date of board approval.

Does your community foundation observe reasonable protections for scholarship applicant information?

Note: It is no longer commonplace to collect student social security numbers or ask for parental/household financial information beyond FAFSA requirements. When storing and retrieving information, or distributing information to the scholarship committee, carefully consider your process for ensuring student and parent confidentiality. Nondisclosure rules vary from state to state. State requirements must be fulfilled regardless of the foundation's privacy/confidentiality policy and record retention policies.

The National Standards Board lauds community foundations for their ability to be innovative with their business models. The following questions represent business model trends for community foundations. As a result, the review is more subjective than in other areas of the submission. This section is not meant to determine whether your community foundation has met National Standards just by answering the question affirmatively. However, we understand there is additional legal due diligence required with these activities.

Supporting Organizations

Are you a named supported foundation of any Supporting Organizations? If yes to any, please provide evidence requested.

- If Type 1, show evidence that you select their board

- If Type 2, show evidence of common board members

- If Type 3, show IRS filing of Type 3

Management of Assets

Do you hold or manage any assets in a form other than a component fund? In other words, do you manage assets that you don't own? One example of this would be if you manage assets as a broker/dealer for agency funds that came to the foundation as a transfer rather than a gift to a fund.

If yes, please provide documentation supporting how your community foundation reviews legal compliance of this activity and makes decisions about how to engage in this activity.

Insurance Regulations

Does your foundation comply with state insurance regulations for charitable gift annuities?